Health Insurance & Medicare Specialist

Call or Text Us for Help

Medicare Supplement

Having the proper health insurance coverage can literally be a matter of life or death. We'll make sure you're family is properly covered with health insurance premiums you can afford.

Complete the details below to get a quote

What is Health Insurance?

Health insurance is coverage that provides for the payments of benefits as a result of sickness or injury. Includes insurance for losses from accident, medical expense, disability, or accidental death and dismemberment.

Health Insurance Types

Health Maintenance Organizations (HMOs) and Exclusive Provider Organizations (EPOs)

MOs and EPOs may limit coverage to providers inside their networks. A network is a list of doctors, hospitals, and other health care providers that provide medical care to members of a specific health plan. If you use a doctor or facility that isn't in the HMO’s network, you may have to pay the full cost of the services provided.

HMO members usually have a primary care doctor and must get referrals to see specialists. This is generally not true for EPOs.

Preferred Provider Organizations (PPOs) and Point-of-Service plans (POS)

These insurance plans give you a choice of getting care within or outside of a provider network. With PPO or POS plans, you may use out-of-network providers and facilities, but you’ll have to pay more than if you use in-network ones. If you have a PPO plan, you can visit any doctor without a referral..

If you have a POS plan, you can visit any in-network provider without a referral, but you’ll need one to visit a provider out-of-network.

High Deductible Health Plan (HDHP)

High Deductible Health Plans typically feature lower premiums and higher deductibles than traditional insurance plans.

If you have an HDHP, you can use a health savings account or a health reimbursement arrangement to pay for qualified out-of-pocket medical costs. This can lower the amount of federal tax you owe.

Catastrophic Health Insurance Plan

A catastrophic health insurance plan covers essential health benefits but has a very high deductible. This means it provides a kind of "safety net" coverage in case you have an accident or serious illness.

Catastrophic plans usually do not provide coverage for services like prescription drugs or shots.

Premiums for catastrophic plans may be lower than traditional health insurance plans, but deductibles are usually much higher.

Short Term Health Insurance Plan

Some of the features offered by short term health insurance are outlined below.

Less expensive that regular health insurance plans

Provides emergency medical services coverage.

Flexible coverage period between 30 days to 12 months.

Can go into effect as soon as the next day.

Can enroll at any time during the year.

Short term health insurance is also good for people who are:

In between jobs or waiting on health benefits to begin.

No longer covered under parent’s insurance policy

Waiting on Medicare or other government-sponsored health care.

Recent college graduates.

Students.

New immigrants.

Healthy and don't go to the Dr. alot.

Contact us to learn more about the right health insurance for you.

Additional Types of Insurance Quotes:

Self Employed Quotes

Short Term Health Insurance Quotes

Dental Quotes

Vision Quotes

Pets Insurance Quotes

Find Perfect Health Insurance For Your Current Situation.

Find the best health insurance options for Individuals, Families and Self Employed. With help from licensed experts.

Fixed Benefit Indemnity Quotes

Long Term Care

Cancer Quotes

Disability Quotes

What makes us different?

Quick 30 second form

No SSN required

Your information is kept private

Zero Cost

Zero Obligation

Zero Hassle

About Us

The Mantua Insurance Group is your premier source of Individual Health, Group Health, Medicare, Life, and Supplemental Insurance products and services. Our expert team of agents is committed to helping you find the perfect solution for all of your health insurance needs. READ MORE ABOUT US

What makes us different?

Quick 30 second form

No SSN required

What makes us different?

Your information is kept private

Zero Cost

Zero Obligation

Zero Hassle

Meet Our Team

Gino Mantua

Agent / Owner

Lori Mantua

Agency Relations

Mark Thruman

Agent Support / Scheduler

Gus Mantua

Marketing / Agent Support

Contact Us Today

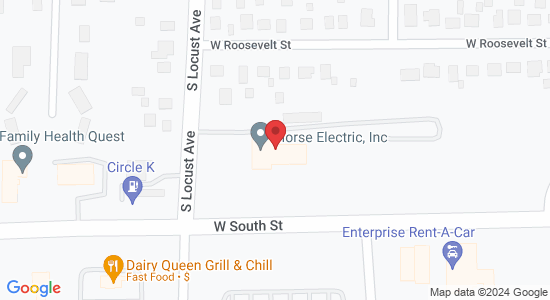

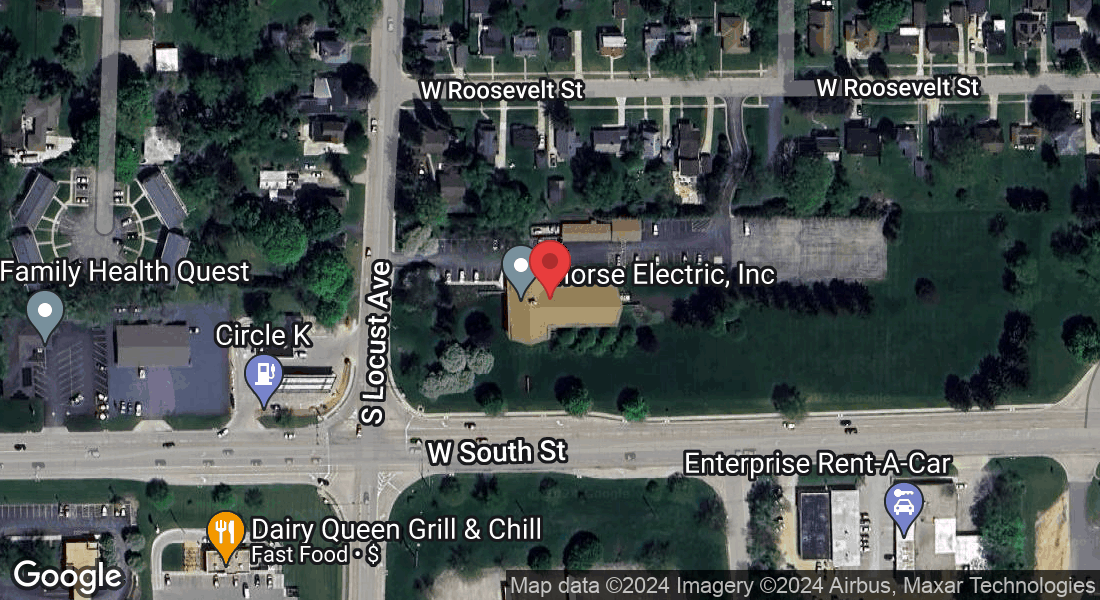

Location:

Healthcare Solutions Team - Freeport

Medicare Plan Helpers

500 W South St

Freeport, IL 61032

Agency Hours:

Weekdays 8:00 am - 5:00 pm

Saturday 10:00 am - 3:00 pm

By Appointment Only

To request plan information without providing personal information, please call +1(815)908-5309.

We are not affiliated with any plan or endorsed by any government entity or agency. We connect individuals with insurance providers and other affiliates (collectively, “Partners”) to give you, the consumer, an opportunity to get information about insurance and connect with licensed insurance agents. By completing the quotes form or calling the number listed above, you will be directed to a Partner that can connect you to an appropriately licensed insurance agent who can answer your questions and discuss plan options. This site is operated by Mantua Insurance Group, a licensed insurance agency, operating through its designated agent, Gino Mantua, only where licensed and appointed. Gino Mantua's Health and Life Insurance License numbers are available upon request and are provided where required by law. Gino Mantua's residence state is IL, where his license # is 17665033.

Products are provided exclusively by our partners, but not all offer the same plans or options. Possible options may be offered include, but are not limited to, ACA-Qualified Plans, Medicare Plans, Short Term Plans, Christian/Health Sharing Plans, Fixed Indemnity, Dental, and Vision Plans. Descriptions are for informational purposes only and subject to change.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Copyright © 2018-2023 Mantua Insurance Group, LLC. All Right Reserved.

Navigation

Policy Services

Resources

Contact Us

Mantua Insurance Group, LLC

500 W South St

Freeport, IL 61032

Toll Free: 888-744-3072

Office: 815-908-5309